Claims Management

Claims Handling / TPA Services

Our experienced claims team can be a huge asset for insurers clients, offering efficiency, expertise, and cost savings. Here’s a sample of what they bring to the table:

Expert Claim Handling

Skilled professionals managing your claims with precision, ensuring fair and timely settlements and reduction of claims leakage.

Scalability & Flexibility

We can adapt our resources based on demand, preventing bottlenecks during peak claim periods.

Cost Efficiency

Reduces the need for extensive in-house claims processing and saves on operational costs.

Enhanced Customer Experience

Faster processing times and knowledgeable staff lead to higher client satisfaction.

Compliance & Risk Management

Experts stay up to date on regulations, minimising legal risks and ensuring proper handling.

Collaborative Working

We work with you to ensure that your regulatory obligations are met and our claims consultants can ensure that the service provides you with clear Management Information and dovetails with your existing processes and Consumer Duty requirements.

We can utilise your existing systems and also supplement your claims team on a temporary basis to help with surges or in times of growth or staffing shortages (i.e. maternity cover)

We see this as a trusted partnership and look to work together so that you have sufficient oversight and the confidence that your customers are receiving a market-leading service.

Large Loss Handling / Oversight

We are experienced in both large loss handling and large loss oversight, ensuring that accurate reserves are in place and that the correct strategies are being pursued.

We co-ordinate with adjusters, legal panel, counsel and experts to ensure an optimal resolution. We will report matters to, and update, reinsurers where necessary to ensure you meet your contractual obligations and can recover the monies under such a contract.

Credit Hire Claims Handling

We pride ourselves at Annexis on our credit hire negotiation strategies and ability to manage and dispute inflated or unreasonable credit hire claims to reduce costs for insurers.

Intervention

Where there is fault against your insured, we will contact third parties instantly to offer an alternative vehicle which will significantly reduce the hire charges you face. Utilising market leading technology, we will also supply basic hire rates so if the intervention is unsuccessful, this lays the foundations for the defence / reduction of the third party hire claim.

We will challenge the hire charges on the basis of:

- Hire Rates & Duration of Hire (BHR and repair / replacement delays)

- Mitigation of Loss (Need / Vehicle Type)

- Fraud & Exaggeration (Phantom Hires, Staged Accidents / Connections between suppliers)

- Claimant's Financial Situation (Challenge arguments of impecuniosity)

Using Annexis Solutions Credit Hire Defence service will result in significant savings in respect of third-party hire (claims costs) and also reduce operational costs.

We are happy to discuss flexible fee arrangements such as risk and reward.

Legacy Claims Handling Expertise

At Annexis Solutions we are highly experienced in the management of claims for insurance portfolios that are no longer actively underwriting. We have worked alongside the GFSC and FSCS on a recent failure and we are particularly experienced in the following:

- Legacy liabilities (i.e. discontinued lines).

- Insolvent insurers (i.e. managing claims for liquidated carriers).

- Portfolio transfers (i.e. after mergers or exits from a market).

We can work alongside your company in the following areas:

Claims Resolution

- Efficiently settling outstanding claims while minimising costs.

- Prioritising high-exposure or complex claims (i.e. long-tail liabilities).

Reserving & Financial Analysis

- Accurately estimating reserves to avoid under / over-provisioning.

- Actuarial support to project future claim payouts.

Legal & Compliance

- Handling disputes, litigation, and regulatory requirements.

- Ensuring compliance with regulatory obligations.

Reinsurance Recovery

- Maximizing recoveries from reinsurers for valid claims.

- Tracking and collecting reinsurance balances.

Data & Technology

- Legacy system modernisation for claims tracking.

- Predictive analytics to identify settlement opportunities.

Our Specific Ares of Run-Off Expertise

- Cost Control: Prevents claims inflation or fraud in dormant portfolios.

- Capital Release: Helps insurers free up capital tied to legacy liabilities.

- Reputation Protection: Ensures fair treatment of policyholders.

We have experience of dealing with claims where FSCS protection is required and engaging with the regulator and insolvency practitioners.

Recoveries & Dual Insurance

Often the last thought of claims handling, or a main source of leakage, is the opportunity to pursue recoveries from third parties.

We understand the importance of the recoveries to minimise loss ratios and maximise company profits to contribute to the financial stability of your company.

We analyse the book of business and the insurance arrangements to determine recovery potential, using our Data experts to build a portfolio of recovery opportunities.

We also offer services for loss recovery including the recovery of excesses, uninsured property, payments made in error, storage / recovery and hire.

Our bespoke handling service, includes the following areas:

- Motor insurance

- Property insurance

- Liability insurance

- Health insurance

We engage with responsible parties, insurers, or legal teams to recover these costs on your behalf and can work on a fixed fee or risk and reward basis with the aim of maximising financial returns to ensure that our clients recoup as much of their paid-out losses as possible.

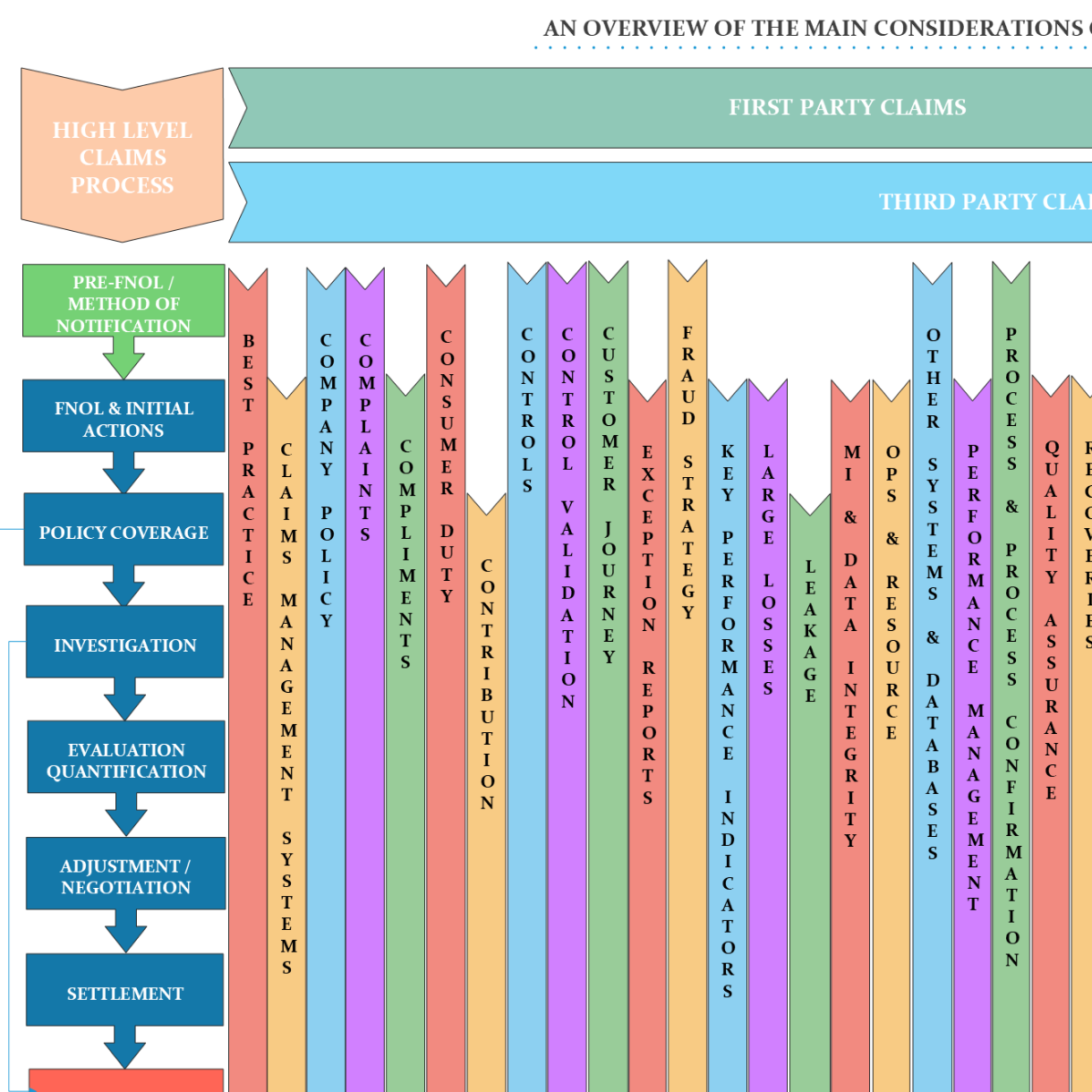

Claims Environment

We understand the challenges that insurance companies face in terms of providing an effective claims service and increasing pressure from the Regulator to do things differently and better. Our aim is to help our clients through these troublesome times and help them implement the changes needed to protect their business and their customers.

We offer a comprehensive range of services that we can tailor to your specific requirements, and some examples are below.

Controls

The controls environment is often neglected. There may be in-built limited controls in claims management systems but they are often ineffective and severe risks such as leakage, reputational damage, breach of regulations and customer complaints. We provide the expertise to review and make improvements and also institute a system of control validation (testing). Prevention is better than the cure.

We will carry out a documented risk assessment of your claims control environment and highlight any crucial gaps / risks along with a plan to improve this which may require technological solutions.

Ultimately, the goal is have as many automatic preventative controls as practicable and effective detective controls where this is not possible or is not cost-effective.

Processes

Claims processes are often passed on verbally from staff member to new recruit because the time is rarely invested in documenting the same. This leads to nuances and variations in processes and often inconsistent approaches which can cause difficulties and can be difficult to identify and even harder to correct.

We will look at your main processes and document and redesign if necessary. We will institute a system of process change, and process confirmation to ensure that these are maintained going forward which will assist in times of audit.

Supplier Management

We help our clients source suitable suppliers for new and existing businesses and can help with selection processes and agreeing SLAs, agreeing fees and reporting requirements.

We support the relationship by conducting / participating in performance reviews to ensure the service meets the required and agreed standards.

Training & Coaching

We ensure that we bake in training requirements into any project that involves change and are also able to provide specific training and coaching to your existing staff on all matters involving claims.

Often, when training is arranged it tends to be academic in nature rather than practical or focussed specifically to the claims your business generates and this is where we can add value to upskill your existing staff on issues they encounter every day.

We need your consent to load the translations

We use a third-party service to translate the website content that may collect data about your activity. Please review the details in the privacy policy and accept the service to view the translations.